For the first time in six years, Virginia’s largest utility, which serves two-thirds of Virginia’s residential customers, will submit to a review of its base rates. Dominion Energy’s “triennial review,” coming after years of regulators reporting hundreds of millions of dollars in company overearnings, will likely be the powerful utility’s biggest battle of the year.

The outcome will determine whether the base rates it charges have been reasonable, how much it’s earned over the past four years and what profits shareholders will be allowed to reap as the company embarks on an ambitious Democrat-driven mission to transform the foundation of Virginia’s electric grid from fossil fuels to renewables.

But instead of playing out in political skirmishes in the General Assembly, this contest will unfold before the State Corporation Commission, one of the most powerful and little-known of Virginia’s government bodies which since 1902 has had the authority under the state Constitution to regulate utilities.

The process is complicated, confusing even to those in the thick of it and rooted in accounting and technical minutiae. Here’s some questions you might have — and some answers to make sense of it all.

Why does this matter?

At the most basic level, the triennial review matters because it determines whether the base rates Dominion’s customers have been paying over the past four years have been reasonable. If regulators decide they’ve been too high, customers could be entitled to some compensation for having overpaid.

Under current law both Dominion and Appalachian Power Company must undergo triennial reviews. Appalachian’s review wrapped up in November with the SCC deciding to leave base rates as is, although both the company and the Office of the Attorney General are appealing the case to the Supreme Court of Virginia.

Dominion’s review, however, is the one everyone has been waiting for. The company is the state’s largest electric utility and serves over 5 million of Virginia’s 8.5 million residents. Because its territory is concentrated in the eastern part of the state, including the Interstate 95 corridor, it also literally powers most of Virginia’s economy, as well as much of its military infrastructure.

Over the years, Dominion has also amassed significant political interest. They have long been the state’s biggest corporate political donor, eclipsed only briefly in 2019 by Michael Bills, a Charlottesville millionaire who founded advocacy group and PAC Clean Virginia explicitly to counter Dominion’s influence in Richmond. However, in recent years a growing number of Democrats have renounced the company’s donations.

Why is it called a triennial review when it covers four years?

Let’s get this one out of the way: Yes, Dominion’s 2021 triennial review covers the four years from 2017 to 2020. No, it does not make sense.

Appalachian’s triennial in 2020 did cover three years, as advertised. When lawmakers set up the triennial system under 2018’s Grid Transformation and Security Act, they wanted to stagger the two companies’ base rate reviews, meaning one would cover the correct time increment and one would have to go short or long. They settled on giving Dominion four years for the first triennial before settling into a three-year pattern but for ease left the label intact.

Why does the state get to have a say over a private electric company’s rates and earnings?

Under what’s known as the “regulatory compact,” a state grants a utility (here Dominion) a monopoly over electric service in an area in exchange for agreeing to have its rates and earnings set by the state.

Both existing federal and state laws, as well as well-established legal precedent from the U.S. Supreme Court’s 1923 Bluefield and 1944 Hope decisions, guarantee all utilities the right to recoup their costs from customers, as well as a fair rate of return.

What are ‘base’ rates? Is that different than an electric rate?

Yes and no. In the most traditional model, regulators look at what a utility has earned over the review period and how that stacks up against what the utility was allowed to earn, which is equal to its expenses over the period (the cost of service) plus an approved profit margin for investors (the return on equity).

Over the years, however, states have tweaked this framework as the energy industry has become more complex and policymakers and regulators have tried to incentivize certain goals like technological innovation, renewables development, long-range planning and judicious spending.

When Virginia re-regulated its electric utilities in 2007 after a brief experiment with deregulation, it began regulating Dominion and Appalachian Power differently than the state’s other utilities. The new law, backed by Dominion, created what one company consultant in the current case describes as an “unusually specific” regulatory framework and offered investors some new incentives.

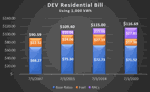

Today customers of these two utilities pay a combination of base rates as well as fuel costs and a set of other charges known as rate adjustment clauses or riders. Riders cover the costs of specific expenses like environmental cleanup obligations or certain generation facilities. Since 2007, base rates have constituted the largest portion of customers’ bills, and almost all of the increases customers have seen have been due to fuel costs and other riders.

Dominion residential bills, 2007-2020

So, what does the triennial review actually do?

There’s three main parts to the review. First, regulators look at what the utility has earned over the review period and how that stacks up against what it was allowed to earn: the cost of service plus the approved return for investors. Dominion’s current approved profit margin is 9.2 percent.

Second, based on their calculation of earnings, regulators determine whether the base rates should change. Virginia law establishes an earnings “collar” or band of 0.7 percent above and below the allowed profit margin. In this case, that would be a profit of 8.5 to 9.9 percent. If the utility earns within that band, base rates cannot be changed. If it earns above the upper limit of that range, 70 percent of those excess earnings have to be given back to customers in some form. If it earns below the bottom limit, regulators must order a rate increase.

Still not complicated enough?

Currently there are two more restrictions written into state law: the 2018 Grid Transformation and Security Act forbid the SCC from ordering a rate increase in this year’s triennial review and capped any customer refunds at $50 million.

Third, and finally, regulators will set the new profit margin for investors based on factors like what other comparable utilities are offering, the utility’s financial health and how much capital it expects to need in coming years. That profit margin, the return on equity, will apply not only to the base rate but to any riders the company has as well.

I’ve heard Dominion has overearned over the past few years. Will this review lead to me getting a refund?

Probably not. The State Corporation Commission has issued regular annual reports showing that Dominion has reaped profits far above its allowed margin, amounting to $502 million in excess earnings between 2017 and 2019. This is far, far more than the $37 million in excess profit Dominion is claiming for the 2017-2020 triennial period.

One reason for that gap is auditing, or a lack thereof. The SCC annual report is just that — a report — while a triennial review is a rigorous audit of earnings and expenses.

“Staff simply reports the numbers provided to it by the company regarding its base rate financial results for a particular calendar year on a regulatory accounting basis,” SCC spokesperson Ken Schrad wrote in an email. “There was no audit or investigation of the financial information provided by the company. The company has always taken the position that those numbers would not necessarily be reflective of the result of any fully-litigated earnings review case before the commission.”

By the end of the triennial review, the SCC may determine that Dominion did earn more than $37 million in excess profits. But customers almost certainly won’t see any of that in the form of a refund. That’s because of another provision in the 2018 Grid Transformation and Security Act that lets the utility apply overearnings to the cost of investments in new solar or wind generation or distribution grid transformation projects instead of returning them to customers as refunds.

Dominion consultant John Reed describes this tool — called a customer credit reinvestment offset, or CCRO — as “akin to using money in the bank to pay cash up front for a home or a car rather than choosing to finance that purchase over time through a mortgage or car loan.” But the mechanism has been controversial since its inception, and House Democrats fought an unsuccessful battle during the 2021 legislative session to do away with it.

Why is this all so complicated?

One reason why rate reviews are such a headache to follow is because they are essentially an elaborate exercise in accounting, driven by a variety of different goals.

Because utilities like Appalachian and Dominion are private companies, they are seeking to maximize their profits within the guardrails the state has established, and their accounting is tailored to that aim. Meanwhile, consumer protection groups and the Office of the Attorney General through its Division of Consumer Counsel are seeking to maximize the benefits consumers receive, and their approach to the accounting is tailored to that aim. Theoretically, the SCC will ultimately arrive at a final accounting that balances both desires.

A bigger reason for the complexity, though, is the predilection of Virginia legislators, including some who have been the biggest recipients of the utilities’ donations, for tinkering with electric utility regulation. While many states leave regulation largely in the hands of public utility commissions like the SCC, Virginia lawmakers have enshrined many of their preferences in statute, often encouraged by Dominion and Appalachian lobbyists.

The final result is a thicket of laws that restrict the authority the SCC has in various circumstances and leave room for varying interpretations of what the law requires. If you’re wondering, How bad can it be?, take a quick gander at this passage of state law — part of a 12,765-word section on rate reviews — governing how Dominion and Appalachian can account for certain costs:

In any triennial review proceeding, for the purposes of reviewing earnings on the utility’s rates for generation and distribution services, the following utility generation and distribution costs not proposed for recovery under any other subdivision of this subsection, as recorded per books by the utility for financial reporting purposes and accrued against income, shall be attributed to the test periods under review and deemed fully recovered in the period recorded: costs associated with asset impairments related to early retirement determinations made by the utility for utility generation facilities fueled by coal, natural gas, or oil or for automated meter reading electric distribution service meters; costs associated with projects necessary to comply with state or federal environmental laws, regulations, or judicial or administrative orders relating to coal combustion by-product management that the utility does not petition to recover through a rate adjustment clause pursuant to subdivision 5 e; costs associated with severe weather events; and costs associated with natural disasters. Such costs shall be deemed to have been recovered from customers through rates for generation and distribution services in effect during the test periods under review unless such costs, individually or in the aggregate, together with the utility’s other costs, revenues, and investments to be recovered through rates for generation and distribution services, result in the utility’s earned return on its generation and distribution services for the combined test periods under review to fall more than 50 basis points below the fair combined rate of return authorized under subdivision 2 for such periods or, for any test period commencing after December 31, 2012, for a Phase II Utility and after December 31, 2013, for a Phase I Utility, to fall more than 70 basis points below the fair combined rate of return authorized under subdivision 2 for such periods. In such cases, the Commission shall, in such triennial review proceeding, authorize deferred recovery of such costs and allow the utility to amortize and recover such deferred costs over future periods as determined by the Commission. The aggregate amount of such deferred costs shall not exceed an amount that would, together with the utility’s other costs, revenues, and investments to be recovered through rates for generation and distribution services, cause the utility’s earned return on its generation and distribution services to exceed the fair rate of return authorized under subdivision 2, less 50 basis points, for the combined test periods under review or, for any test period commencing after December 31, 2012, for a Phase II Utility and after December 31, 2013, for a Phase I Utility, to exceed the fair rate of return authorized under subdivision 2 less 70 basis points. Nothing in this section shall limit the Commission’s authority, pursuant to the provisions of Chapter 10 (§ 56-232 et seq.), including specifically § 56-235.2, following the review of combined test period earnings of the utility in a triennial review, for normalization of nonrecurring test period costs and annualized adjustments for future costs, in determining any appropriate increase or decrease in the utility’s rates for generation and distribution services pursuant to subdivision 8 a or 8 c.

Simple, huh?

"Review" - Google News

April 09, 2021 at 08:53PM

https://ift.tt/321DH3p

Virginia explained: What's triennial review and why should you care? - Fauquier Times

"Review" - Google News

https://ift.tt/2YqLwiz

https://ift.tt/3c9nRHD

Bagikan Berita Ini

0 Response to "Virginia explained: What's triennial review and why should you care? - Fauquier Times"

Post a Comment