The mutual fund industry is poised to lose its crown as the dominant passive investment vehicle, with the non-active exchange traded fund sector on track to surpass it for the first time.

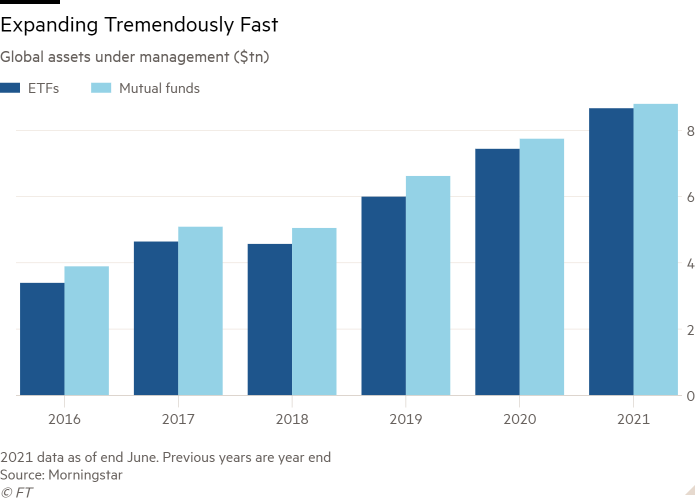

Global assets under management of passive, index-tracking ETFs hit a record $8.66tn at the end of June, according to data from Morningstar, just $132bn shy of those in passive mutual funds.

The gap has narrowed from $623bn at the end of 2019 and $305bn in December 2020, suggesting that stronger inflows will make ETFs the dominant format for index investment globally in the second half of this year.

Andrew Jamieson, global head of ETF product at Citi, said the rise of ETFs was “clearly the direction of travel” with the fund structure “setting new records [for assets under management] all the time”.

Net flows into ETFs hit a record $661bn in the first six months of the year, according to consultancy ETFGI, smashing the previous first-half record of $294bn set in 2020.

“I have been working in the industry for eight years and from the first day I walked in it has been assumed that ETFs are the future. They are just a more efficient fund wrapper than the traditional mutual fund,” said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar.

Passive ETFs have already overtaken index-based mutual funds in the US, where the instruments have an explicit tax advantage due to a quirk in capital gains tax regulations.

When mutual fund investors redeem, the fund sells some of its underlying holdings in a “cash” transaction, potentially triggering a capital gains tax liability for all investors, even those not redeeming.

In contrast, ETFs do not usually need to sell their underlying securities, instead delivering baskets of securities “in-kind” to the authorised participants that create and redeem ETF shares. Trading activity and any capital gains thus occur outside the fund so there is no tax pass-through to investors.

Inflows in to ETFs for the year so far in the US hit $506bn last week, comfortably ahead of the $411bn pumped in the country’s mutual funds cumulatively since 2014, according to SPDR ETFs.

While the US tax advantage does not apply elsewhere, ETFs are still often cheaper than mutual funds, more transparent in terms of their holdings and more liquid, offering intraday trading, whereas mutual fund transactions take a day or two to be processed.

“In the US, assets in passive ETFs have already surpassed passive mutual funds. Outside of the US, it’s very possible this trend will continue as we are seeing the general trend towards greater adoption by a wider range of investors,” said Eamonn O’Callaghan, vice-president, European ETF product at Brown Brothers Harriman,

Bankers and analysts agree that holdout investors will come under increasing pressure to adapt to ETFs.

Martin Gilbert, founder and former CEO of Aberdeen Asset Management, lent weight to this argument recently, saying “one of the mistakes I made [at Aberdeen] was not realising how big [ETFs] would get. Asset managers should have an ETF business; it is the future.”

AssetCo, Gilbert’s latest outfit, unveiled a deal to buy a majority stake in thematic provider Rize ETF in July.

With ETFs poised for supremacy in the passive field, the question is whether they could eventually overhaul mutual funds for active investment as well.

Lamont believed there were “huge regulatory barriers which would need to be crossed” for this to happen, with few countries outside the US yet having approved the portfolio-shielding non-transparent ETF models that many active managers crave.

“There is a consensus that even for active funds the ETF wrapper is still superior but the advantages are not enormous over the traditional fund structure, so there isn’t a huge incentive for asset managers to pile into the active ETF space,” he said.

However Jamieson was confident that active ETFs would “surpass mutual funds in time”. Indeed, looking out further still, he questioned the long-term survival of mutual funds at all.

“In many ways, the ETF wrapper is just the mutual fund version 2.0,” he said.

"choice" - Google News

August 09, 2021 at 11:15AM

https://ift.tt/3xrVUEE

ETFs set to overtake mutual funds as passive vehicle of choice - Financial Times

"choice" - Google News

https://ift.tt/2WiOHpU

https://ift.tt/3c9nRHD

Bagikan Berita Ini

0 Response to "ETFs set to overtake mutual funds as passive vehicle of choice - Financial Times"

Post a Comment