We think that Baxter International (NYSE: BAX) currently is a better pick compared to Boston Scientific (NYSE: BSX). BAX stock trades at about 3.6x trailing Revenues, compared to around 5.2x for Boston Scientific. Does this gap in Baxter’s valuation make sense? While Boston Scientific’s business has been impacted in 2020 due to deferment of elective surgeries, Baxter’s business has seen an increased demand for peritoneal dialysis patient growth. Boston Scientific stock is being backed by investors given the expected rebound in procedure volume in 2021, implying strong sales for the company’s products. In fact, Boston Scientific’s sales are estimated to grow 15% in 2021 compared to just a 5% growth for Baxter. However, there is more to the comparison. Let’s step back to look at the fuller picture of the relative valuation of the two companies by looking at historical Revenue Growth as well as Operating Income and Operating Margin growth. Our dashboard Baxter vs. Boston Scientific: BAX stock looks very undervalued compared to BSX stock has more details on this. Parts of the analysis are summarized below.

1. Revenue Growth

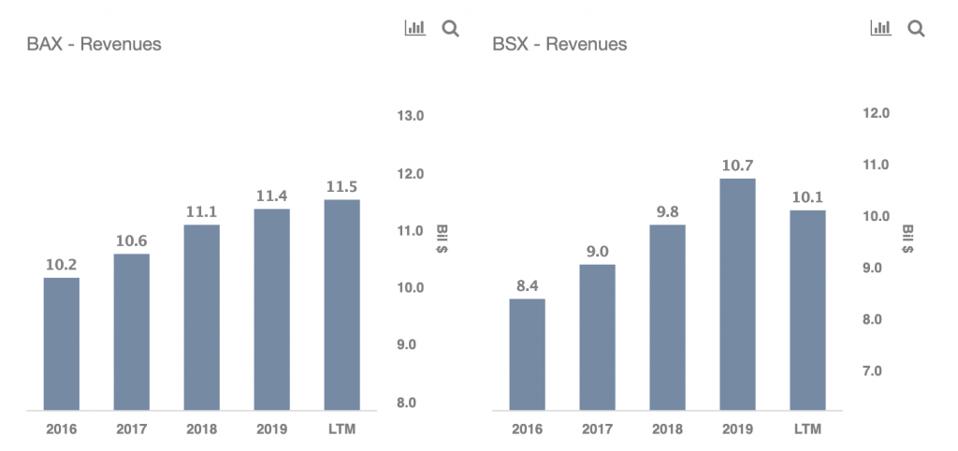

Baxter’s Revenue grew 12% from $10.2 billion in 2016 to $11.4 billion in 2019, aided by advanced surgery products sales growth. Over the last 12 months, the revenue growth was 3.1%. Looking at Boston Scientific, total Revenue grew 27% from $8.4 billion in 2016 to $10.7 billion in 2019, partly led by higher demand for its Neuromodulation and Endoscopy products. However, the revenue for the last twelve months was down 2.7%, impacted by deferment of elective surgeries due to the pandemic in the first half of 2020.

2. Operating Income

Baxter’s operating income grew from $0.7 billion in 2016 to $1.7 billion in 2019, reflecting a 2.4x growth, led by both an increase in revenues and expansion of operating margins, which grew from 6.7% to 15.0% over the same period. Looking at Boston Scientific, the operating income grew a solid 3x from $0.5 billion in 2016 to $1.5 billion in 2019. Boston Scientific also saw expansion of margins from 5.6% to 14.4% over the same period. However, as we look at the last twelve months figures, the operating margin for both the companies has declined owing to increased costs during the pandemic. Operating margin of 6.7% for Baxter is much higher than a little under 1% for Boston Scientific.

The Net of It All

Although Boston Scientific’s Revenue growth compares favorably with Baxter over the recent years, Baxter’s growth has been better over the last twelve months. Also, Baxter’s operating margins have trended better compared to Boston Scientific. As such, we think the difference in P/S multiple of 3.6x for Baxter versus 5.2x for Boston Scientific will likely narrow going forward. Both the companies are seeing a pickup in demand of late, as the economies open up gradually after the pandemic, and now with vaccines being approved over multiple countries, it appears that perhaps soon the worst of the pandemic will be behind us. Now Boston Scientific’s revenue is expected to grow 15% from an estimated $10.0 billion in 2020 to $11.6 billion in 2021, while Baxter’s revenue is expected to grow 5% to $12.1 billion in 2021 compared to an estimated figure of $11.5 billion in 2020. While Boston Scientific’s revenues are expected to grow at a faster pace, the difference in P/S multiple with that of Baxter is likely to narrow, implying BAX stock could offer better growth in the near term.

Trefis

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 100% return since 2016, versus about 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

"choice" - Google News

January 13, 2021 at 08:30PM

https://ift.tt/3qhDfbn

Baxter Is A Better Choice Than Boston Scientific Stock - Forbes

"choice" - Google News

https://ift.tt/2WiOHpU

https://ift.tt/3c9nRHD

Bagikan Berita Ini

0 Response to "Baxter Is A Better Choice Than Boston Scientific Stock - Forbes"

Post a Comment